Crack-up at the Grifters' Laboratory

The Silicon Valley burn-rate on your ethics is much faster than the public health requires from a runway to produce a solution, and it's disgusting that this is a valid framing for your biotech

I recently misplaced a copy of Bad Blood I purchased for $38 at La Guardia airport last summer on a trip for work, which is fine, it was a good book, I’d read it before, but digesting this story yet again, I'm tired of hearing any version of it that isn't bookended with "capitalism is a corrupting influence on the sciences and it's fascism to let capitalists do it".

The thing about Theranos is this: With sufficient, time, capital, ethical oversight, and competent leadership, Elizabeth’s Holmes’ vision would’ve likely become a reality, but all things considered, where it all falls apart is, at the heart of the matter, capitalism is the disease and not the symptom; the symptom was giving a college drop-out with no biological sciences credential millions to found this company, as was the lack of due diligence from pharmacies who went into business with her, as were the scientists who came on board only to have their professional-ethical objections gagged by Silicon Valley Standard Operating Procedure for this kind of highly-seeded work. The symptom was the presumption that the public health could be gambled with for institutional profit, and in this case, not just Holmes, but anyone who failed to do their due diligence before exposing the public to Theranos’ work.

This isn’t just about Theranos, this is a about a culture that finds it appropriate for profit motive to play a role in the development and market prospects of science in the public interest; I’ve discussed this before with other commodities, things like mainstream art and consumable goods, but the disgusting element is that the same monopolistic forces that govern what even gets made in order for us to have the choice to buy it are now, after a very long time of this happening so far beyond the curtain that no one seemed to realized there was widespread suppression of results, or nefarious motive in not bringing research to bear, it is happening with the public’s health.

During a global pandemic, no less, we’re seeing this play out in the form of private corporations gatekeeping the production of allegedly more effective, cheaper, easier, faster tests, with the state unwilling to foot the bill, and venture capital circling like vultures, and it’s a better time than ever to evaluate the role our system, broadly, plays in developing our drugs, our supplies, etc. while also seeing the perilous road ahead from the precedent set already that Theranos merely followed, and tried to expand upon.

The idea that Silicon Valley founders can be highly-funded, fail, and still not be ruined is not new, but we’re at a repulsive new level, is what is my main point, and not only is it the conglomerates doing things like directing funds to research to maximize profit, rather than most efficient treatments, or creating artificially short runways for research, so results do not bear out (consider, for example, that absent the influence of capitalism, Cuba has produced a lung cancer therapy with reliable survivability for recipients over a longer period of trials with these outcomes than might typically be pursued if the goal were primarily profit motivated market entry) as they might if the artifice of budget constraints in biotech weren’t present, but also we’re applying the high-velocity, churn, and boom-bust cycle of the dotcom era to this field as well, with the regulatory bodies failing to act in time. The genius of the marketing of Silicon Valley companies like this, not merely web shops, e-commerce SaaS, etc. but things that have industrial, practical use coming out of these startups is that they can, and in the case of Theranos, did, frame this inability to comply with regulation as a failure on the part of the regulators to modernize, rather than their unwillingness to comply, and the risk is entirely on unsuspecting consumers.

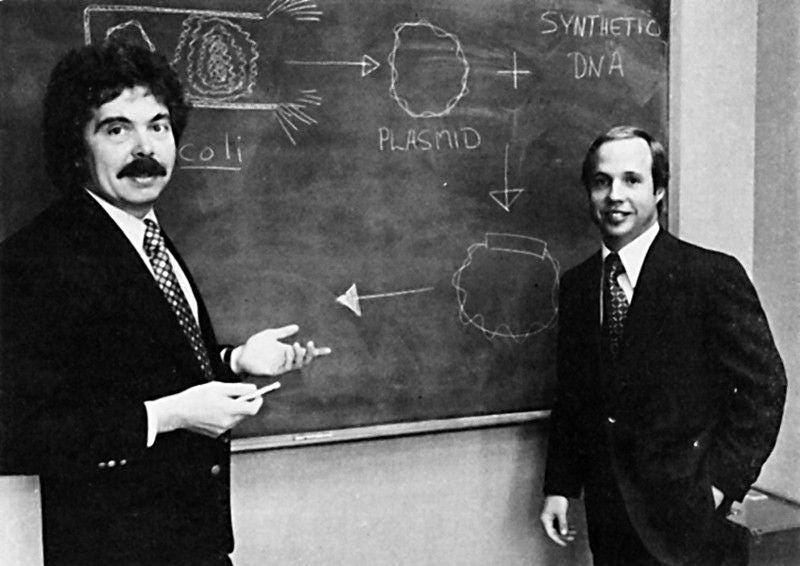

Let’s back up to 20+ years ago, biotech in Silicon Valley isn’t new, and neither is particularly novel “hard” science being shopped to Sand Hill Road as a start-up opportunity, and all of this—Genentech, notably, for example- was all about breakthroughs in developing product, but even back then, we could discuss these companies with the air of erudition that one expects from someone doing their job ethically. However, this would prove not to be the case, from lobbying against the public interest in healthcare policy (with Congressman parroting lines from their lobbyists on the Senate floor) to patent disputes with its publicly-funded researchers in the University of California system, to ultimately, its acquisition by (allegedly) one of the most evil corporations to ever exist in the biotechnology field, Roche.

This was just the success story— heralded, even today, as a homegrown, American business to achieve a multi-billion dollar valuation before being acquired by *sirens* literal war criminals, which, incidentally, had held a majority stake in Genentech since 1990. The point of this history is that even the pretext of legality doesn’t insulate these companies from the corruption of multi-national corporations with billions sunk into lobbying, while also relying on the grifting of Silicon Valley fundraising, and the privilege to be regarded as such by regulators, while also being enriched on the backs of taxpayers. The difference between this scenario and Theranos is that Holmes and her lieutenants were arrogant; you can’t run a scam like this without buy-in from the industry and lobbyists, for good or ill, and it was an attempt to shift this Overton Window of what diagnostic supply companies could (fail to) deliver while spending the least on working in the public interest, while also appearing to have done nothing wrong. They tried to scam their would-be conspirators, who bore the brunt of this commercially by failing to vet the prodigy.

Sure, pharmaceutical and medical supply companies have long been, at least in corporatist states, scum; look no further than most of the conglomerates in this field coming out of World War II, having supplied the Nazis with everything from lab resources to chemicals to personnel, completely unscathed as enterprises. This, however, should only make this virulent strain of capitalist intrigue more alarming; the field is deregulating rapidly, alongside a culture of shifting governmental oversight to third-party bodies, and in the case of industry in the United States, often the corporations themselves for self-regulation, it’s only a matter of time before these companies are regulating themselves within the US as well. In the case of Theranos, they made it all the way to in-store trials of a machine they couldn’t even prove worked before anyone nailed Holmes on this grift, and this was a start-up with ties to Stanford, alongside of tech’s most prestigious investors.

Zooming out, this brings the entire practice of venture capital into view as an accelerant for this kind of behavior; we saw it with banking, we’re seeing it with real estate, we’re seeing with transit, and now with the hard sciences, all being reduced down into the crush of meeting deadlines under an unqualified burn-rate that, of course, as it had with Theranos, will produce mediocre, even dangerous results, in an effort to deliver, rather than fulfill.

I think this speaks to a deeper complex, and a denial of the fundamental fact about business, but Silicon Valley in particular, that the meritocracy isn’t real, but to accept that is to accept that valuation, shipping product, etc. are all arbitrary metrics rewarded arbitrarily, and usually commensurately with connections, the kind of cushion to expect when/if a venture fails, etc. because ultimately, there is only one measure of success for a capitalist at the end of their career, irrespective of import or impact of said contributions:

In The New New Thing, Michael Lewis takes us through the third-act of the career of Jim Clark, the founder of Silicon Graphics:

and CEO of Netscape:

Lewis, however, tells a story of Clark, unsatisfied after becoming a legendary figure in computer science for his technical brilliance in the former, and his foresight in leadership in the latter, simply because, despite his machines becoming a cultural touchstone themselves as well as what they produced, he had failed to become a billionaire, and thus wanted one last chance at becoming at it, on an ill-advised venture that wouldn’t even be memorable, if not for the past accomplishments of his career, Healtheon, only notable for its eventual acquisition by WebMD.

My point in mentioning Clark is that, for all he accomplished using the collective knowledge of his field (he was a PhD in Computer Science) and creating a revolution in computer graphics, as well as driving development of consumer-adjacent machines to do this work, and for his role in making the web the accessible tool it is for the public today, the part that pains him the most is not that he wasn’t unrecognized, it’s he wasn’t paid according to the scale founders and CEOs feel is due to them by virtue of the bogus meritocracy of Silicon Valley.

This is the intellectually bankrupting effect of hypercapitalism—it’s never enough- and one can see how mere aspiration for more can turn into desperation for more—not just as individuals but also an industry0 two decades later as the scope of what can be venture funded, what can be incubated, and what can ultimately be made to maximize as business while doing the least in production as it’s perceived to be the greatest innovation worthiest of the biggest payday for its founders.

Extras

Recent things I’ve read, listened to, or watched that I am now recommending:

Eat the Rich Podcast - Ep. 30 Roche

The Billion-Dollar Molecule: The Quest for the Perfect Drug by Barry Werth